OPPORTUNITY IN THE MIDDLE EAST

Dubai is the number one city in the world for international capital into new developments.

The opportunity in the Middle East’s real estate market is unprecedented, and it is becoming a global proptech hub.

PropTech Connect is hosting the Middle East’s Largest Real Estate Tech Event February 2026 in Dubai, where global executives, investors, and entrepreneurs are coming together to seize this opportunity.

in partnership with:

Dubai is the number one city in the world for international capital into new developments.

The opportunity in the Middle East’s real estate market is unprecedented, and it is becoming a global proptech hub.

PropTech Connect is hosting the Middle East’s Largest Real Estate Tech Event February 2026 in Dubai, where global executives, investors, and entrepreneurs are coming together to seize this opportunity.

in partnership with:

MIDDLE EAST REAL ESTATE MARKET

CAGR of 8.2%

Predicted Market Growth rate in 2025-2033

USD 388.7 Billion

Market Size in 2024

USD 834.8 Billion

Predicted Market Size in 2033

1. GCC (Gulf Cooperation Council) states in the Middle East show strong growth in GDP, dominating the market regarding capital deployment and high-growth projects.

2. Non-GCC countries offer a large market size for development and penetration with opportunity for arbitrage and scaling.

KEY DEVELOPMENTS, TRENDS aND DRIVERS

Key Developments

Palm Jebel Ali is a new development that is set to be 50% larger than Palm Jumeirah and will hold marinas, a water theme park and residential villas.

NEOM is a futuristic region that is under development in Saudi Arabia, powered by 100% renewable energy in line with the 2030 vision on the country. Set to contain groudbreaking projects such as The Line, Oxagon, Tojena and the Sindalah.

The Red Sea, a regenerative tourism project is set to attract further tourism, with an area over 28,000 square km.

Lusail City, a major development in Qatar, is a planned city that hosted the final of the 2022 World Cup. It continues to be developed with a focus on sustainability and smart city technology.

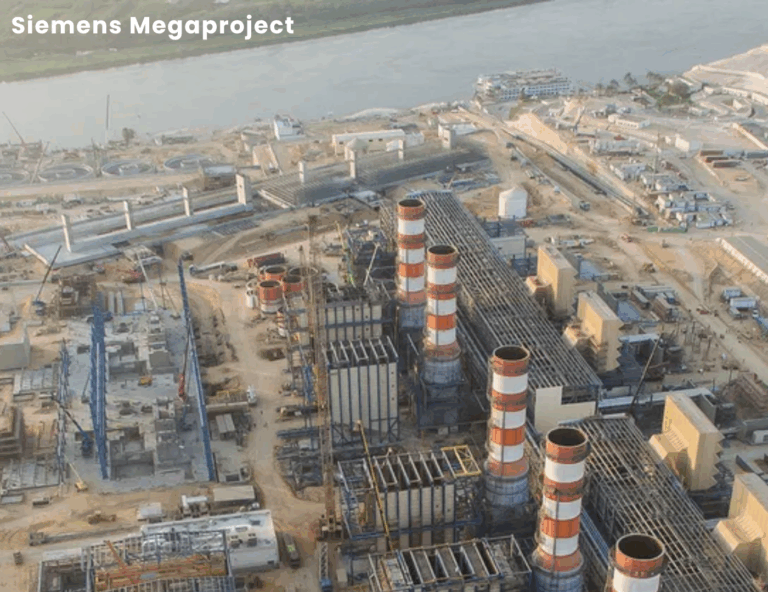

Siemens Megaproject in Egypt is a revolutionary development for the countries energy sector, involving the construction of three of the world’s largest combined-cycle power plants.

Smart Cities and Sustainability Focus

There is a growing demand for sustainability within real estate, with many countries pushing their ESG vision strategies, such as the UAE Green Agenda 2015-2030, Dubai Vision 2030, Saudi Arabia Vision 2030, Bahrain’s Economic Vision 2030, Qatar’s National Vision 2030, and Oman’s Vision 2040. These strategies prioritise reaching net-zero emissions and pushing forward green initiatives in real estate, employing PropTech and new technologies to achieve this. Countries are starting to pivot from oil reliance and focusing on sectors like investment into tourism, logistics and tech.

Regulatory Reform

Regulatory reforms have been a focus for the Middle East, creating an accessible route for international real estate investment and ownership. Countries like the UAE, Bahrain, Saudi Arabia, and Oman offer Golden Visa incentives, allowing for investors to gain long term residency. Meanwhile, Saudi Arabia’s new Property Laws, allow for real estate foreign ownership with a focus to its major cities of Riyadh and Jeddah. Such policy and initiatives aim to push more FDI into the region. Simultaneously, Sovereign wealth funds (SWFs) are still strong in the region and are projected to grow by over 50% and reach $8.8 trillion by 2030.

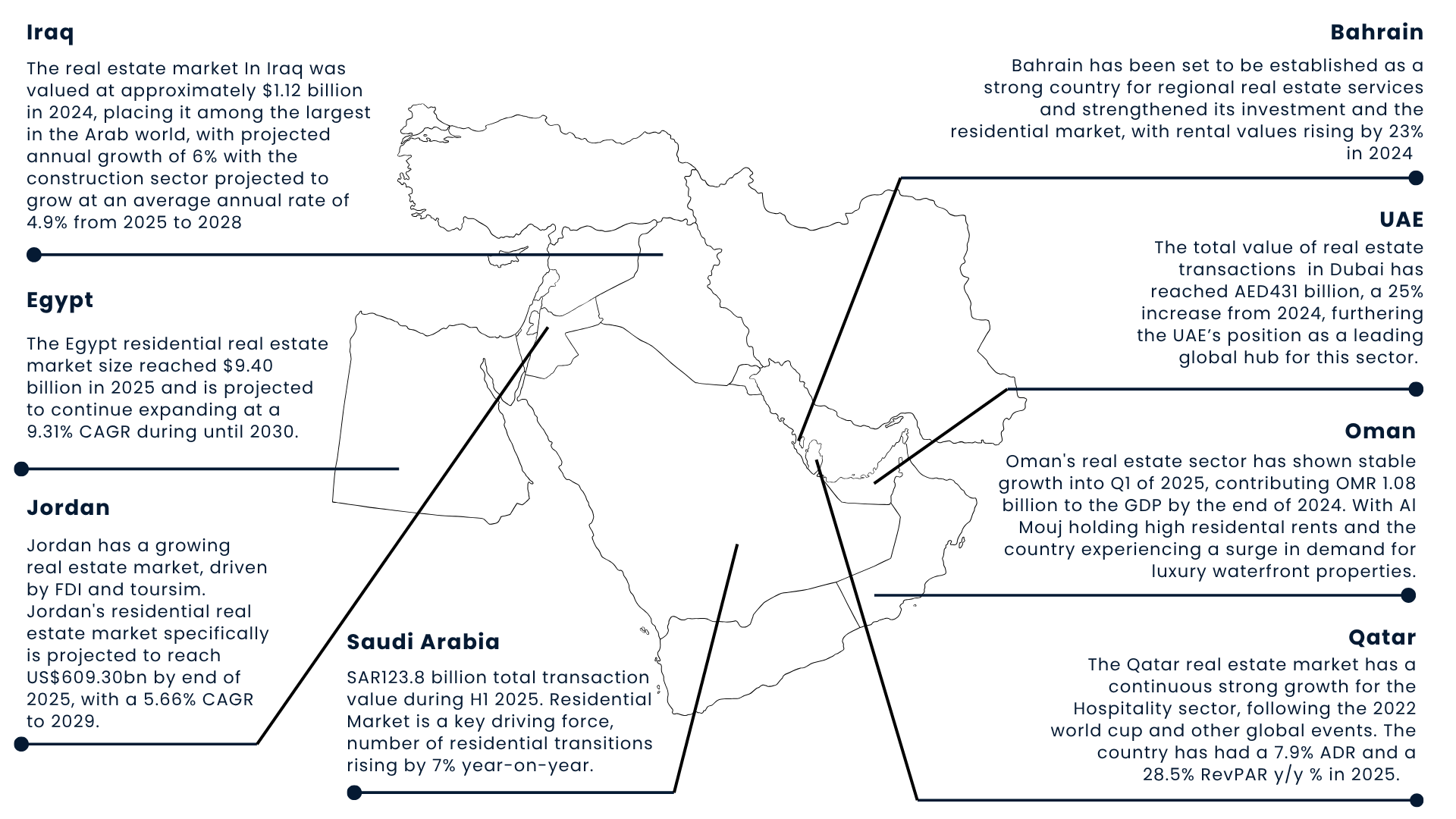

REGIONAL OVERVIEW - KEY MARKETS

Iraq

The real estate market In Iraq was valued at approximately $1.12 billion in 2024, placing it among the largest in the Arab world, with projected annual growth of 6% with the construction sector projected to grow at an average annual rate of 4.9% from 2025 to 2028

Saudi Arabia

SAR123.8 billion total transaction value during H1 2025. Residential Market is a key driving force, number of residential transitions rising by 7% year-on-year.

Bahrain

Bahrain has been set to be established as a strong country for regional real estate services and strengthened its investment and the residential market, with rental values rising by 23% in 2024

UAE

The total value of real estate transactions in Dubai has reached AED431 billion, a 25% increase from 2024, furthering the UAE’s position as a leading global hub for this sector.

Qatar

The Qatar real estate market has a continuous strong growth for the Hospitality sector, following the 2022 world cup and other global events. The country has had a 7.9% ADR and a 28.5% RevPAR y/y % in 2025.

Egypt

The Egypt residential real estate market size reached $9.40 billion in 2025 and is projected to continue expanding at a 9.31% CAGR during until 2030.

SPOTLIGHT ON DUBAI: THE CITY OF THE FUTURE

Dubai is a hub for new developments, with constant innovation and technological improvements laying at the heart of real estate. The city is set to develop 140 branded residential projects by 2031, making it the global leader in the segment. Key current and upcoming developments include:

– Diamondza, an AED 2.4 billion mixed-use residential development

– Bayz 102, located at the Business Bay, with 1,300 fully furnished units

– The Horizon, a mixed-use residential and retail development, offering unobstructed views of the city to residents

– Palm Jebel Ali, an under development project twice the size of Palm Jumeirah

– Six Senses Dubai Marina, set to become the tallest residential building in the world.

– Therme Dubai, an interactive park, designed to host 1.7 million visitors every year, will be set over a 500,000 square feet area.

Tokenization & real-world asset strategies

DAMAC, a Dubai developer, has signed a USD 1 billion deal with blockchain platform MANTRA to tokenize real estate assets, signaling increasing adoption of fractional and digital ownership models.

REITs & capital market monetization

Dubai Holding is preparing a residential REIT IPO, seeking up to USD 487 million by selling a 12.5% stake, reflecting a broader push to convert physical real estate into more liquid investment vehicles.

VOLUME OF TRANSACTIONS

No.1

Dubai Ranked 1st for sales in the Luxury super-prime homes (>$10M) Market

180,000+

Plot Transactions in 2024, totalling over AED 500 billion

94,000+

94,000 property transactions worth AED 262.7 billion in Q1 and Q2 of 2025 (40% YoY increase)

Dubai 2040 Master Plan

Residential Property Development on the rise with the Dubai 2040 Master Plan setting out to establish new affordable housing, develop communities and increase land area for hospitality facilities by 134% and health facilities by 25%.

Secondary Market

Resales and capital gains are rising in the property transactions market, with investors earning 60 billion AED in 2024: a 34% increase from the previous year and 1,300% increase from 5 years.

Ready Built & Off Plan Properties

Dubai has become an increasingly popular option for long term settlement, leading to ready residential properties seeing a 35% rise in value and 15.6% rise in volume in 2025. With continuous development, off plan properties remain dominant, with a 43.2% rise in value and 26.5% rise in volume in 2025.

THE GLOBAL INVESTMENT HUB

No.1

Dubai ranked 1st globally for attracting Greenfield FDI projects

$45 Billion FDI Flow

the UAE has seen a 48% increase in FDI in 2024. Real estate has accounted for 14% of all FDI

43%

of the total value of all residential property in Dubai is owned by Foreign Nationals

“Recording this unprecedented level of FDI inflows to the UAE is an achievement that reflects the strategic choices made by our wise leadership and its long-term vision to establish the UAE as a leading global investment destination”

Mohamed Hassan Alsuwaidi, UAE Minister of Investment.

POLICY, STRUCTURES & INVESTMENT ENABLERS

100%

Tax-Free Property Transactions and Ownership

100%

Foreign Property Ownership Permit

Residency Golden Visas

Open a Gateway to Residency and anchor Capital

Delivery and Risk Management

Government frameworks such as the use of escrow accounts, a mandatory escrow system for off-plan properties and Dubai Land Department’s regulated title registration, which registers all off-plan transactions helps reduce investor risk and ensure transactions are used for their intended purposes.

Growing Tech Infrastructure

Fractional access across all levels of real estate is growing, with tokenization, blockchain registries, and smart contracts being utilised more frequently.

Government Infrastructure

Increased government investment into utilities, connectivity and transport help enhance land value and reduce risk for peripheral development investment.