DropOffer’s thesis is that as desire to find the ideal home continues to dominate buyer preferences and more technology alternatives emerge to facilitate off-market sales, 2023 should see a 2.0 percent increase of off-market volume.

The company believes iBuyers are helping the trend.

“Homeowners are more aware than ever to selling without ever having to list their home traditionally thanks to iBuyers spending hundreds of millions in marketing and educating consumers,” it said in the announcement. “Speed of the deal, privacy and convenience are always favorable to both buyers and sellers, and sellers are often willing to accept less to receive the former.”

Real estate marketing company 1000Watt published research in 2021 that found “77 percent of homeowners would be ‘probably’ or ‘maybe’ willing to take 5 percent to 10 percent less for their home to avoid the hassle of a traditional sale in favor of the convenience and certainty of an instant, cash offer.”

Clever, a proptech that also conducts consumer trend research, found a similar result in a 2022 study.

“People are willing to take $45,400 less for their homes to avoid the current home sale model including the option of choosing a closing date,” Inman reported.

DropOffer’s prediction has legs; but is it a leap? For the average homeowner, maybe.

The company’s most cited examples of off-market deals are the sales of luxury homes, usually those of celebrities who commonly sell privately to avoid public scrutiny.

Manhattan’s luxury market thrived with off-MLS deals recently, according to The Wall Street Journal.

It’s easily argued that the smaller a buying market is for a property, the less exposure it requires to sell. Luxury agents dealing in seven-figure sales know this, and it’s not unusual to know a ready and willing buyer.

And while NAR can’t control how sellers choose to sell their homes, the organization does require listing agents to post homes for sale on the MLS one business day after marketing begins, under the Clear Cooperation Policy.

However, a seller can nix that under Section 1.3 of the Exempt Listings clause, which reads:

If the seller refuses to permit the listing to be disseminated by the service, the participant may then take the listing (office exclusive) and such listing shall be filed with the service but not disseminated to the participants. Filing of the listing should be accompanied by certification signed by the seller that he does not desire the listing to be disseminated by the service.

This rule helps the off-market advocate but also supports sellers in the middle of the market, ensuring their properties can be seen by the most number of people. But even that segment isn’t always happy with the results of their listing agreement, perhaps lending a little credence to DropOffer’s prediction.

An average of 2 percent of homes for sale across the United States were pulled from the market in the 12-week period ending Nov. 20, 2022, compared to 1.6 percent during the same period a year earlier, according to data from Redfin. The reason most often cited was price.

“Some sellers are having a hard time grasping that we’re not in a housing-market frenzy anymore — it’s tough for them to swallow that they missed the boat on getting a high price,” Heather Kruayai, a Redfin real estate agent in Jacksonville, said in a statement.

In a phone call with Inman, Clark’s co-founder in DropOffer Greg Burns said the company’s subjective data is also indicating to them that more sellers are looking for a reason not to have to put a for-sale sign in the yard.

“Last couple years, we’ve seen it, more responses and hand raises from sellers willing to sell off market,” he said. “And buyer interest, while it has calmed down, pent-up demand remains, and inventory issues will only get exacerbated. Sellers are more educated on the fact that there is another way to sell. We jumped in on that frustration. You want to sell conveniently, but not give away your house.”

A year ago this month, Beach Properties of Florida executive Jimmy Burgess said that 2022 would be “the year of the off-market deal.” He made the prognostication at an Inman Connect Now event.

To serve their buyers in a low-inventory environment, Burgess said there’s room for meeting their buyers’ needs by pitching potential sellers on the attractiveness of the market. If the buyer loves a particular neighborhood and is willing to pay a premium to live there, this information may be enough to entice a homeowner to sell, he said.

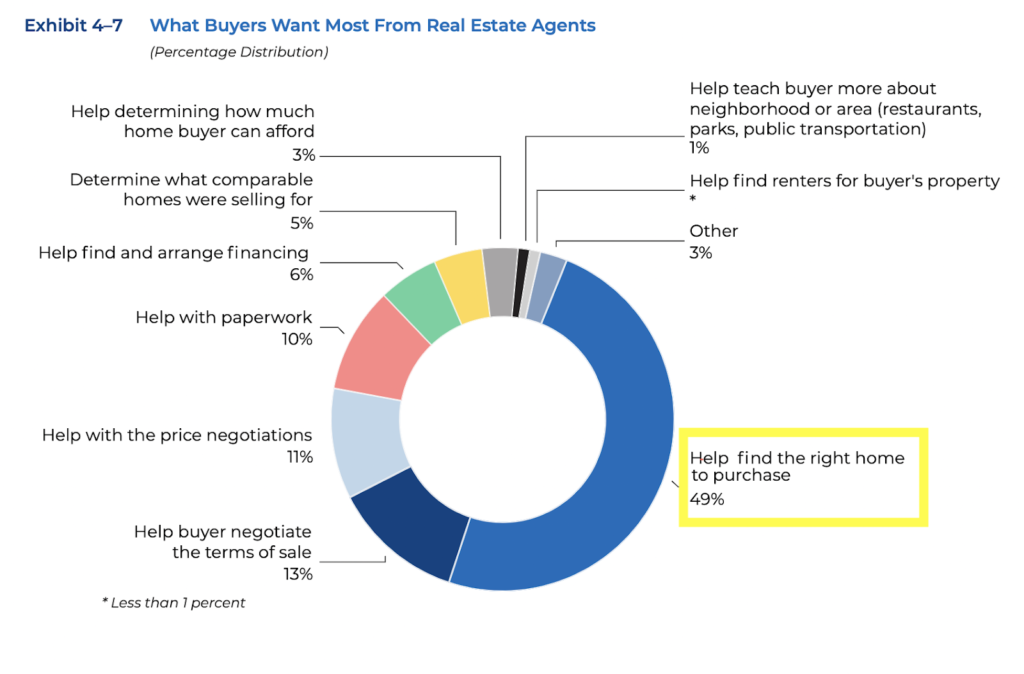

DropOffer’s model is predicated on a buyer’s demand for wanting the right house, and the NAR survey data backs them and clearly so does Burgess. But how much more is the buyer willing to pay for that “right house?”