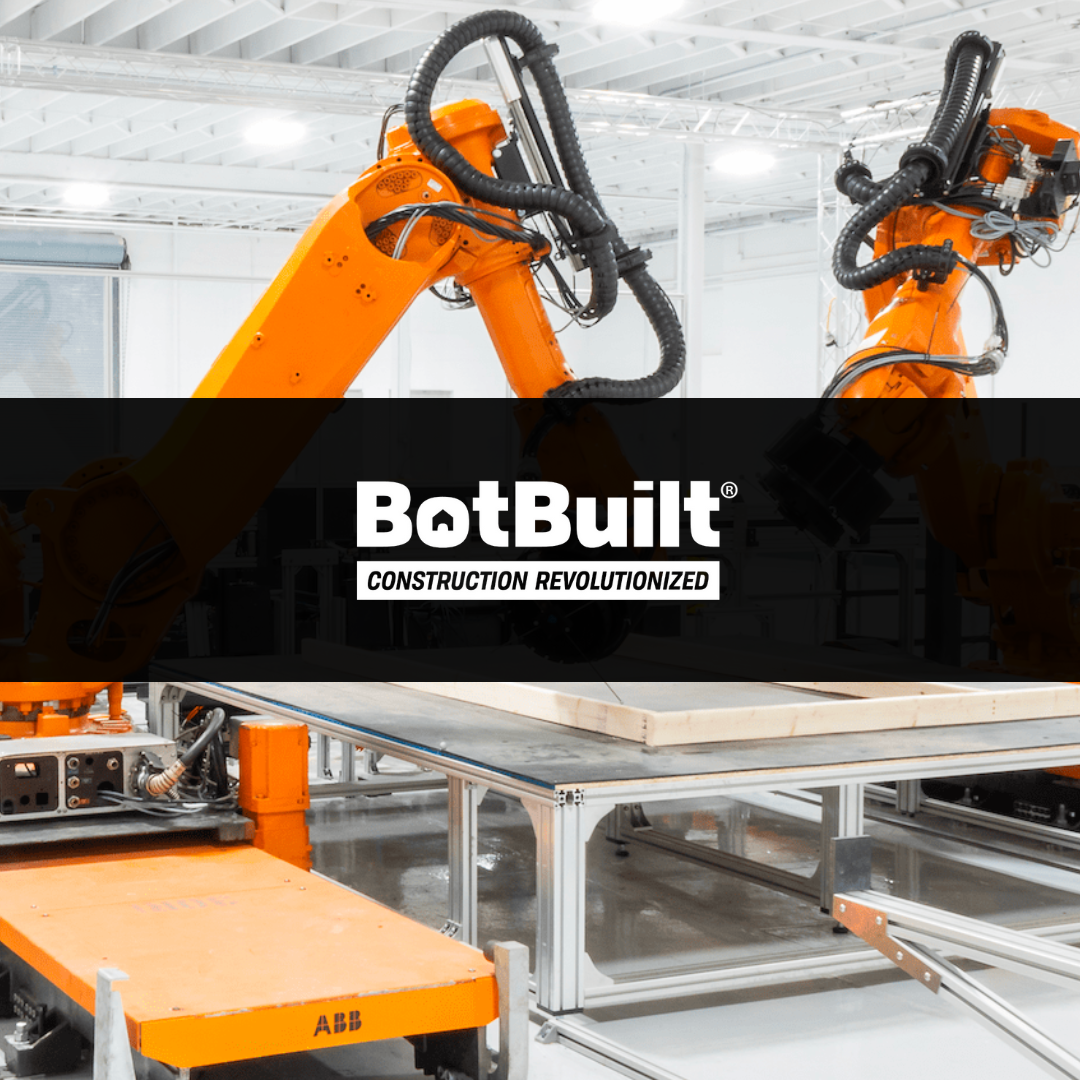

BotBuilt’s robotics piece together panels for walls, floor trusses and roof trusses, several of the major framing components of homes. The company’s system, which ostensibly costs around $1 per hour to run, can be reprogrammed to build “entirely” different frame designs for homes relatively quickly, Ames says.

“The flexibility of our robotic systems is our … big advantage,” Ames said. “Prior attempts to use robots to innovate within construction have largely relied on hard automation, which means that robots are programmed to do the same task over and over again. This approach works well for repetitive tasks like building cars, but it’s a poor fit for the construction industry, where there’s a huge variety of designs.”

By automating the framing step, it’s Ames’ theory that the pace of homebuilding can be dramatically accelerated while reducing costs.

Typically, house framing costs $7 to $16 per square foot, which includes $4 to $10 in framing labor costs. Framing takes about a month, best-case scenario, but factors like bad weather can delay things — as can labor shortages. According to the National Association of Home Builders, more than 55% of single-family homebuilders reported a shortage of skilled labor across homebuilding trades, including framers, in 2021.

BotBuilt primarily provides services to homebuilders. It doesn’t sell the frame-building system itself, but rather operates robot-equipped factories to produce framing for homebuilding customers.

“The timing of framing impacts every other trade involved in the construction process and can make or break a developer’s budget,” Ames said. “The vast majority of … framing components are built by people using manual methods … BotBuilt empowers builders by helping them increase both their volume and margin by leveraging plentiful, high-quality and affordable robotic labor.”

Ames acknowledges that BotBuilt has rivals in the robotics homebuilding space, like Randek, Weinmann and House of Design. Others include Diamond Age and Mighty Homes, both of which have created systems that can print and assemble components like home interiors and roof structures.

BotBuilt is off to a gentle start, with only nine homes built so far and revenue hovering around $75,000. But Ames claims the pace will ramp up in 2024; the plan is to begin shipping trusses built by its robotics while scaling BotBuilt’s general operations, he says.

“Manual wall panel and truss plants operate at 30-40% gross margins, so our level of automation will allow us to be significantly higher than that and still deliver significant cost savings to builders,” Ames says. (He estimates that BotBuilt makes ~$15,000 in revenue per house of wall panels built.) “We already have ten builders with over 2,000 homes and apartment units in our pipeline to build, and we will build them as quickly as we can with our initial two factories.”

To help scale the company, BotBuilt has raised $12.4 million in a seed funding round; previous investors include Ambassador Supply, Y Combinator, Owens Corning and Shadow Ventures. Part of the tranche, which values BotBuilt at $35 million post-money, will be put toward growing the Durham, North Carolina-based company’s team from 13 people to about 20, Ames says.