Adding to Europe’s strong living sector, Heim Global Investor will utilise Heimstaden’s knowledge and resources to position itself as a leading fund manager.

New specialised fund manager investing in Europe’s dynamic and growing living sector Heim Global Investor has recently launched.

The manager builds on over three decades of industrial experience of its sponsor Fredensborg and its affiliate, the pan-European residential private markets leader, Heimstaden who is managing 162,000 homes across nine countries with €30bn in assets.

Heim has been established with a proven team that has deep industry expertise and local presence across major European markets. Heim will offer private markets funds to institutional investors across the risk spectrum, with a focus on the European living sector.

The fund manager will deliver much-needed housing in growing cities characterised by high demand and limited new supply. It has also established a closed-end UK focused residential build-to-core fund targeting £800m in investor commitments, with a planned first close in mid-2024.

“With the launch of Heim, we are introducing a uniquely positioned specialist fund manager building on an experienced team at Heimstaden, renowned for consistently delivering great results to investors. We start out with establishing two related fund strategies driven by specific investor demand and market opportunity. These funds will provide institutional investors access to UK and Northern Europe residential real estate managed with industrial scale and skills.” Andreas Oulle, CIO, Heimstaden, Heim Global Investor

Heim is also launching a closed-end Northern European residential development fund targeting €750m in commitments, with a planned first close in the second half of 2024. The fund manager is part of a group with in-house competencies and track records across fund and investment management, alongside development, asset management and operations.

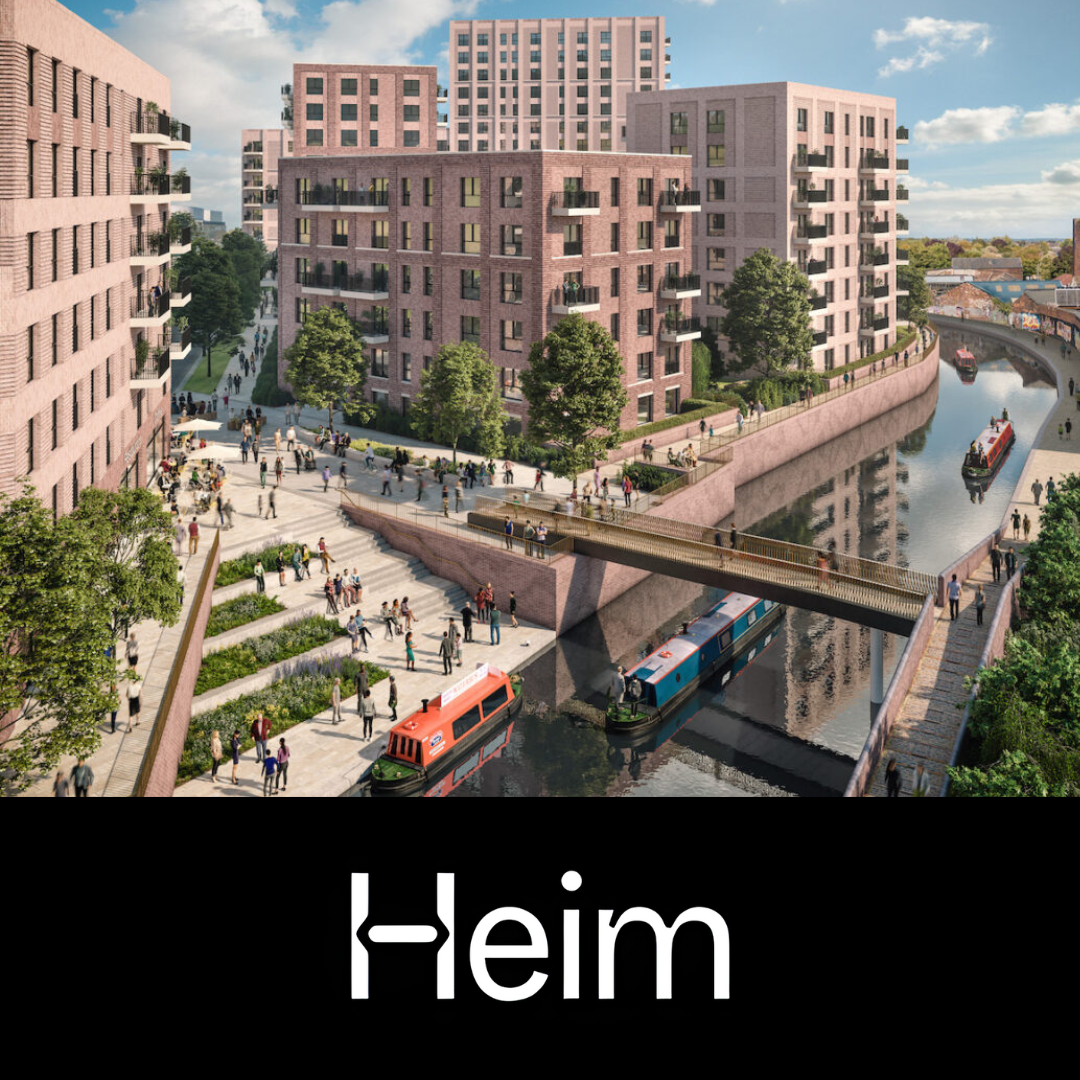

With a sole focus on alternative investment funds (AIF), Heim is an addition to Heimstaden’s role as owner and manager in Heimstaden Bostad (see mock-up above) and operates as a separate and independent fund manager (AlFM).

Building on the same organisational DNA, Scandinavian values, entrepreneurial culture, and 30 years of experience in the living sector, Heim offers institutional investors a proven value creation model.

Heimstaden will maintain its current management of Heimstaden Bostad with an ambitious value creation strategy, supported by a history of strong performance and an aim to grow the platform in the future.

Join our community of 200,000+ real estate leaders and get weekly insights and updates with our newsletter.

*Offer ends on Friday, 7th February.