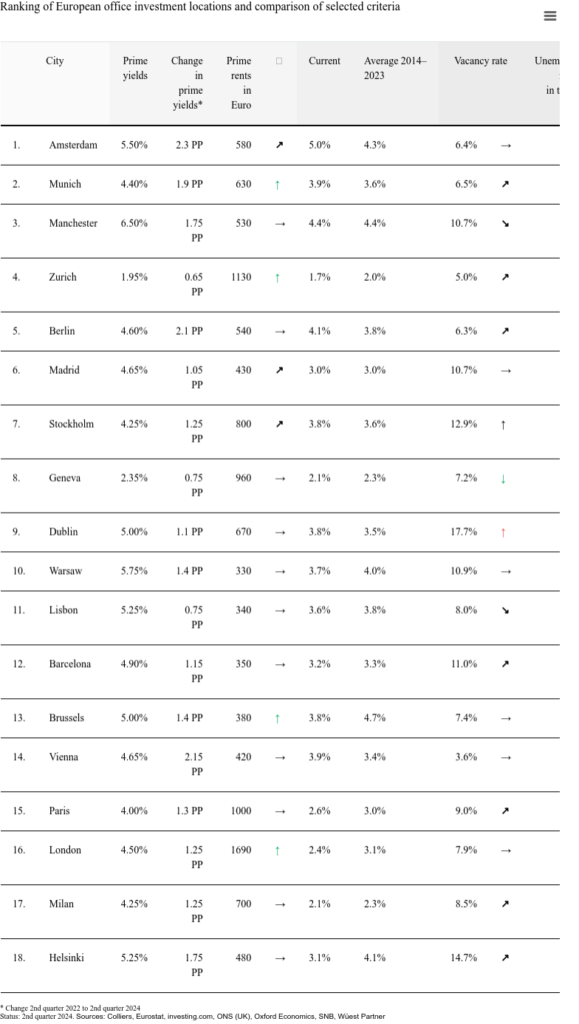

Overall, we examined 13 factors that fall into the areas of market yields and rental price trends, supply dynamics, economic conditions, real estate premiums and performance, and market sentiment. For each of these factors, we compared the 18 cities with each other and assigned them a value between 0 and 1 according to the concept of quantile ranking. For most indicators, but not all, this means: The higher the value, the better the city performs in this factor. We then added up the values of all factors for each city. The city with the highest total is ranked first.

Amsterdam – Rank 1

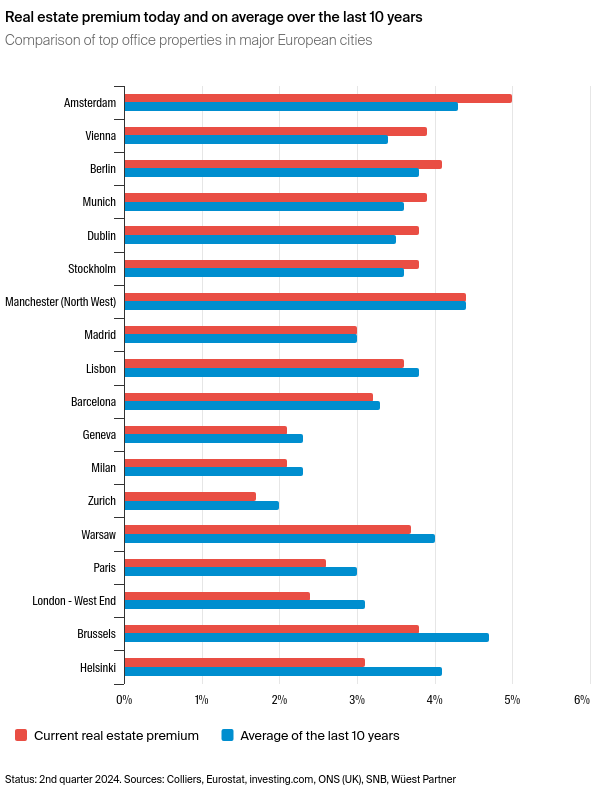

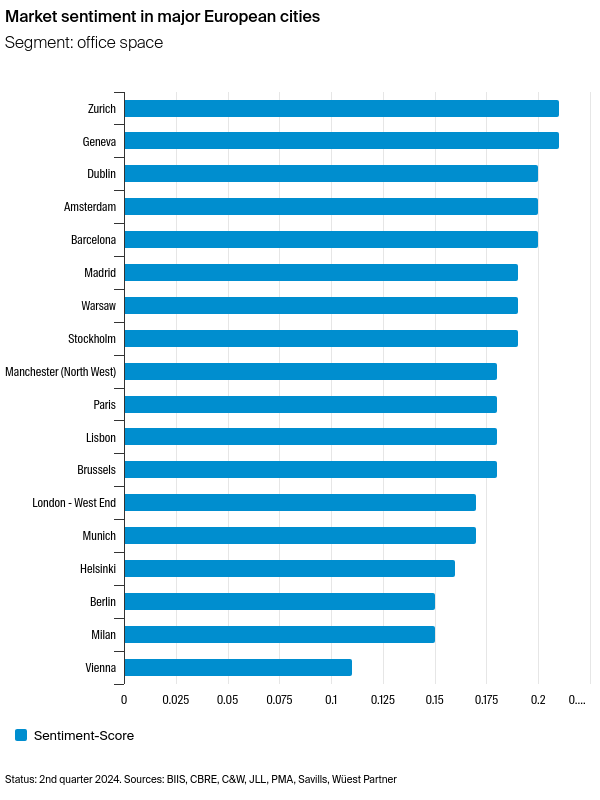

Amsterdam takes first place in our ranking of the most attractive office investment locations in Europe. The city impresses with a current real estate premium that is well above the average of recent years, which indicates particularly attractive yield premiums compared to government bonds. The generally positive market sentiment, confirmed by the sentiment index, reflects the confident attitude of investors towards the Amsterdam real estate market. In addition, the good performance of indirect real estate investments in the Netherlands underlines this attractiveness. A low unemployment rate indicates a robust local economy, which supports demand for office space. In addition, Amsterdam is experiencing above-average growth in prime rents, which holds out the prospect of potential yield increases for investors.

Munich – Rank 2

The current real estate premium is above the average of recent years due to the sharp corrections in initial yields following the interest rate turnaround, which points to attractive yield opportunities. The good performance of indirect real estate investments this year could be a sign that the general downward trend on the German real estate market has bottomed out. Munich is also benefiting from a low unemployment rate and above-average rent increases. The city has a low vacancy rate, even if it has recently increased slightly. However, the sentiment index still shows little confidence, which is an indication that the upturn still needs some time.

Manchester – Rank 3

The top properties in the office space segment are recording high net initial yields, offering investors attractive yield opportunities. The current real estate premium here is in line with the average of recent years. In addition, Manchester recently recorded a decline in the vacancy rate for office space, which could be due to increased demand. The sentiment index reflects a medium level of confidence; the confidence of market participants is stable.